Originally written on April 5, 2018

Happy Spring! In our last market update, we noted that Punxsutawney Phil saw his shadow. As it turns out, his prediction of 6 more weeks of winter was spot on. We also discussed volatility coming back to the markets and we have continued to see just that. In recent client meetings, we have been revisiting the importance of preparing ourselves emotionally for the sudden, severe, and unpredictable stock market drops that are “part of the deal” when it comes to stock market investing.

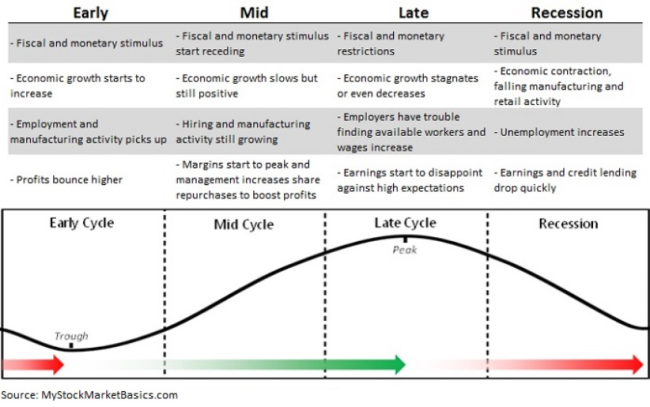

The economy goes through various cycles (see image below). The challenging part, of course, is there is no concrete schedule of how long we stay in any particular phase. The picture below shows a nice even time period for each stage, but in reality, transitions are typically abrupt and sudden and the stock market often moves ahead of the cycles themselves, anticipating what is next. At this point, we know we aren’t in the early stage and we are likely in the mid to late stage of the cycle.

The Good News

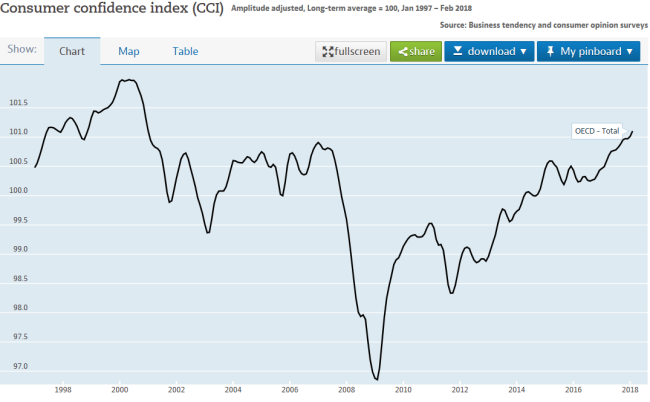

- Consumers are highly confident and tax reform could continue to encourage spending.

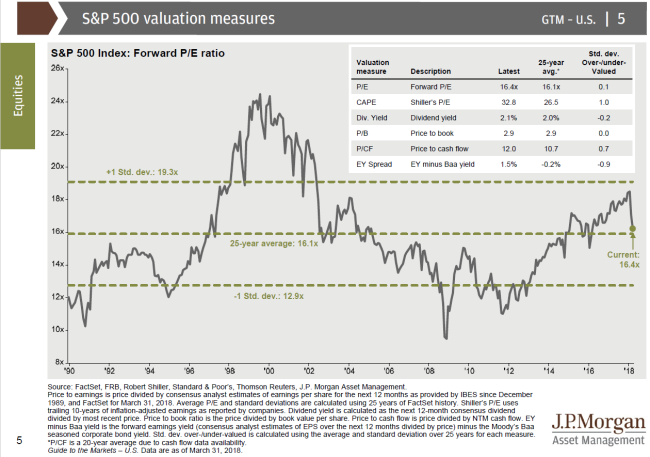

- Corporate Earnings – Earnings growth is estimated at 17.3% for the S&P500 for 2018. This is the highest level of anticipated earnings growth since early 2011.

- The rate of growth in technology across industries has reduced the impact of inflation. The Fed estimates inflation at roughly 1.8%, slightly below their target of 2%.

- Unemployment is at an 18-year low and is expected to go lower.

- The market appears to be fairly valued if we see the strong earnings growth that is projected.

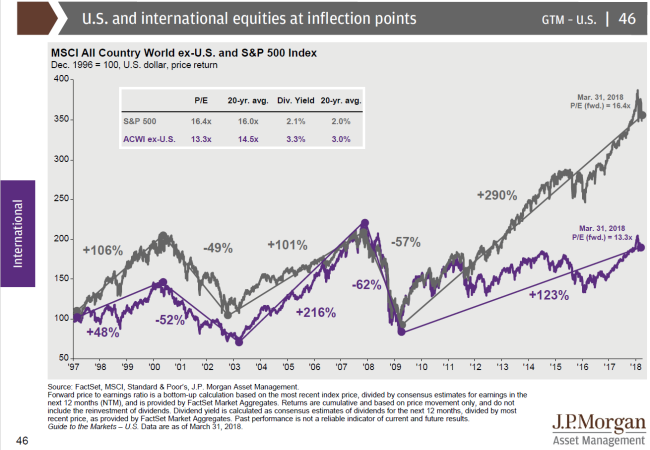

- International Stocks look historically undervalued. U.S. markets have outperformed international markets since 2009. International stocks appear to be cheap and are paying higher dividends on average.

The Not So Good News

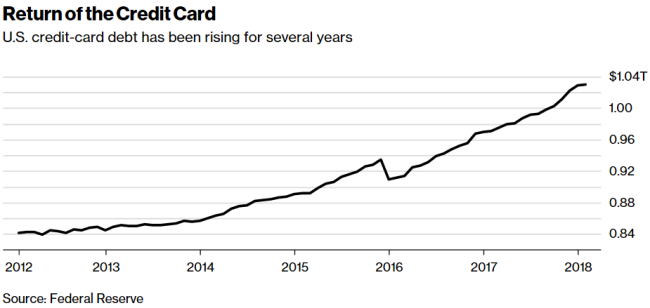

- Consumer spending accounts for 70% of GDP. Consumers are becoming more and more burdened by debt which could limit the amount of future spending that is possible. Household debt increased at the fastest pace since 2007 in the 4th quarter of 2017.

- We have a lack of workers. Wages remain stagnant which is keeping inflation low, but without a growing number of workers, production and therefore growth can be limited.

- Commodity prices are rising. Oil prices are up a little over 25% from last year at this time. We are far from $120/barrel oil but we have seen a run up in prices.

- Uncertainty of what tariffs will mean for the economy. Generally, tariffs are not good for markets. Regardless of intent, they act as a tax on the consumer. The major concern is tariffs creating a “trade war” between countries and those tensions creating additional conflict. We saw this week that China retaliated against the U.S. with tariffs of their own on imports of some U.S. goods.

- Our general stage in the economic cycle. We are now 9 years into a “bull market”. Bull markets are defined as periods when the market increases by 20% or more. The longest bull market was from 1987-2000 which lasted 4,494 days. We are now 3,312 days (As of April 3, 2018) into this run.

Our Response

Given where we are in the market, we are making some changes to our portfolios. We are making modest adjustments to reduce our U.S. stock exposure and increase our international stock allocation. We are also increasing our allocation to international bonds as real rates (interest rate after inflation) are becoming more attractive in some parts of the world. Perhaps most importantly, we are reminding our clients that when we invest in stocks, we have to be emotionally prepared for sudden and dramatic drops. It comes with the territory and the higher long term returns that stocks deliver.

What to Consider

Now is a good time to re-evaluate what you are trying to accomplish financially. Over time, stocks still represent an asset class with high expected returns. Nothing is free though, and to get those high returns you have to be willing to ride out market dips. We expect those dips to be more dramatic than they have been recently with the potential for larger dips down the road.

While things are still positive and may continue that way for a while, we think it is important to run a “stress test” before the next inevitable crash happens. That crash could be in 3 hours or 3 years, but it is a part of investing. Consider how you would feel if the stock market lost 20-30% of it’s value. For the average diversified portfolio, that could mean a short-term drop of between 13-18% in account value. No one wants to lose money - ever, but if that is way out of your comfort zone, now may be a good time to consider reducing your overall risk level. Please feel free to call and discuss your portfolio with us or to schedule a review meeting.

Milestone News

We are growing!!! If you have been in the office over the last few months you may have met Leslee Schoonover, our newest employee! Leslee comes to us with over 17 years of financial services experience and has been a great addition. We are excited to have her on the team!

Feel free to share our market commentary with your friends and family! If you have someone who you think could benefit from our service, we would be honored to help!