“The best time to plant a tree was 20 years ago. The second-best time is now.” – Chinese Proverb.

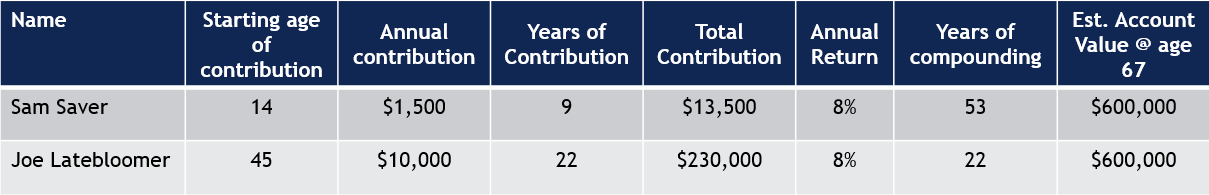

Meet Sam Saver. Sam is 14 years old and just finished 8th grade. Sam knows in a few short years he will be able to get his driver’s permit and can’t help but daydream about pulling into his high school parking lot in a Ford Mustang! Sam works all summer long at the local amusement park and by the end of the summer has accumulated $3,000. He decides to put half of the money into a savings account for his Mustang and puts the other $1,500 into an investment account for his retirement. After a few years of working, he cashes in his savings account and buys his 1996 Mustang with 165,000 miles (that he couldn’t be prouder to own). Sam continues to work at the amusement park every summer, continuing to put $1,500 into an investment account, and the other $1,500 into maintaining his Mustang. Sam goes off to college when he is 18, but every summer he comes home and continues putting $1,500 away each year into his investment account. Sam graduates from college at age 22 with a great job offer in hand that starts in the fall, so he comes home for one last summer working at the amusement park. By the time Sam starts his full-time job, he has made 9 yearly contributions of $1,500 ($13,500 total) into his investment account. Since Sam has a long time horizon until retirement, the funds have been invested entirely in the stock market earning an average return of 8% per year.* Sam begins working full time and simply forgets about his investment account for 45 years. By the time Sam retires at age 67, his investment account with only $13,500 of contributions has grown to a total balance of $600,000.

Now meet Joe Latebloomer. Joe has always wanted to save for retirement, but every time he tries to get serious about doing so, something comes up and Joe kicks the can down the road. Whether it be student loans, paying for a wedding, buying a house, medical bills, car payments, daycare expenses…Joe can never seem to find the time or money to start investing for retirement. After attending a retirement seminar at work, Joe realizes that at 45 years old with no retirement savings, it’s time to get serious and begin saving. Joe analyzes his financial situation and decides to put $10,000 a year away into an investment account every year until he retires. Joe determines that he has a high risk tolerance and decides to invest the account the same way as Sam and earns 8% per year.* By the time Joe retires at age 67, he has contributed $230,000 into his investment account and it has grown to a total balance of $600,000.

*This is a hypothetical example and is for illustrative purposes only. No specific investments were used in this example. Actual results will vary.

Past performance does not guarantee future results

As you can see, the popular Chinese proverb listed above can absolutely be applied to investing for your retirement. While investing at an early age can be difficult and can require discipline and sacrifice at a time when your income may be very low, there is simply no more powerful way to ensure a secure retirement than harnessing the power of compound interest. Meet our team of advisors who can help you by clicking here.