We enter 2023 with a changed investment landscape. Over the course of the last 15 years, investors didn’t have much choice - they could leave their assets in conservative investments (cash or short-term bonds) and get less than 2% on their money, or they could invest it stocks to try and get higher returns. Coming out of the 2008-2009 financial crisis, that was a successful strategy as the stock market (as measured by the S&P 500) earned an average 8.8% per year from 2008 through the end of 2022.

Today, after aggressive interest rate increases from a Federal Reserve hell-bent on lowering inflation, we are in a different world. Last year’s rate increases amounted to the sharpest change in interest rates in the history of the Federal Reserve. That change caused both stock and bond markets to struggle mightily. The Bloomberg Aggregate Bond Index had its worst year on record, posting a return of -13%. This came from an index where a -3% rate of return would normally cause investors to gasp in horror. Growth stocks also struggled as the Nasdaq dropped 32%. Some of the largest companies in the U.S were down over 40% last year. The list includes Amazon, Tesla, Nvidia, Facebook (Meta), and Intel.

As we continue to digest everything that has happened in the last year, it feels like we’ve ripped the band-aid off a nasty cut. It was painful, and it will take some time to heal, but it’s not a terminal injury. Bonds now offer attractive returns and stocks appear to be priced reasonably with some areas screaming, “Sale”! There is some fog on the horizon as we don’t know if we will continue on the track of declining inflation and how much corporate earnings will be impacted by higher borrowing costs, but the skies are clearer than they’ve been in last 10 months. We expect market volatility to continue, but with last year’s market declines, a lot of bad news is already reflected in current asset prices.

SECURE Act 2.0

On December 29, 2022, President Biden signed into law the Consolidated Appropriations Act, 2023, an omnibus spending bill that includes the SECURE 2.0 measure (a.k.a. the Setting Every Community Up for Retirement Act 2.0). Broadly, SECURE 2.0 is intended to make retirement saving more straightforward and accessible to a wider range of people. As such, it encompasses many aspects of financial planning and retirement saving.

With time, as the new law is interpreted and applied, nuances will become clearer. Until then, we will have to interpret the law’s effects based on its language and any guidance the IRS issues.

SECURE 2.0 includes a host of provisions affecting the rules for qualified retirement plans (401(k), 403(b), etc.) and their administration. The bill is quite broad (more than 4,000 pages), so we wanted to highlight a few of the key provisions that will impact most people. We’ve put together a more detailed article on our website if you are interested in reading more. We will also plan to review any impacts specific to you in our next review meeting.

Key Provisions

· Delays the age of Required Minimum Distributions (RMDs) from pre-tax retirement accounts from age 72 to 73, with an eventual increase to age 75 by 2033 (More important, individuals who turned 72 in 2022 should not be affected by this new rule, and the imposition of the new RMD age does not seem to afford the individual the option of delaying their first RMD beyond April 1, 2023.)

· Permits unused funds remaining in 529 college savings plans to be rolled into Roth IRAs (subject to restrictions, including a lifetime rollover limit of $35,000 and a 15-year minimum on account age)

· Indexes IRA catch-up contributions for inflation year-over-year but requires catch-up contributions to be made post-tax to Roth accounts.

· Allows employers to provide matching contributions to an employer sponsored retirement plan equal to an employee’s qualified student loan payments

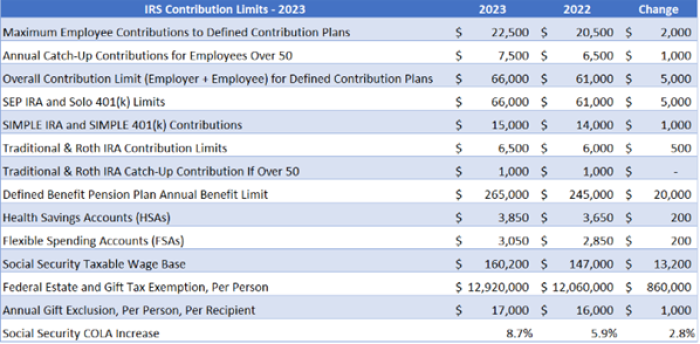

· Eliminates RMDs for Roth accounts in employer sponsored plans Updated IRS Contribution Limits

Updated IRS Contribution Limits

Milestone Updates

Milestone is proud to be sponsoring "Team Lex" for the “Walk MS: Allentown 2023” walk and fundraiser to benefit people affected by multiple sclerosis. The walk is scheduled for 9:30AM on Saturday, April 29th at the Iron Pigs Stadium in Allentown.

You are welcome to join us!

Contact Tyler or follow this link for more information. We hope to see you there!