Originally written on February 7, 2018

We hope this update finds you well! Among the Super Bowl headlines and Punxsutawney Phil seeing his shadow, predicting 6 more weeks of winter, you may have noticed that volatility has returned to the stock market for the first time in a while.

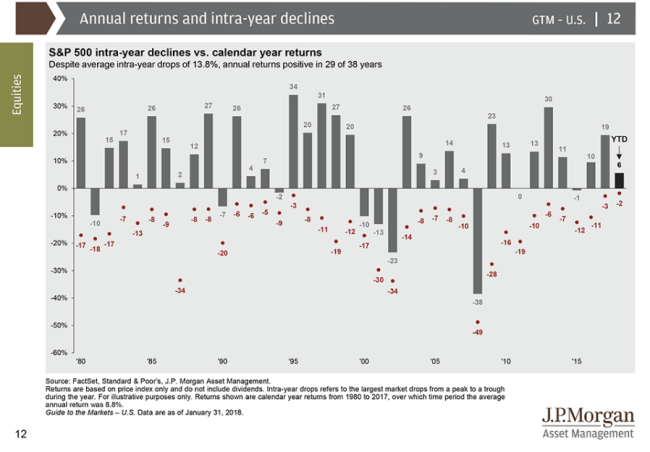

As the graph below shows, while the stock market earns positive returns in most years, it experiences drops within those years of 13.8% on average. If we take out the large declines (1987, 2001, 2002, 2008) an average “correction” of 8%-10% happens about once a year. The last one was at the beginning of 2016, so we were “due” for another dip about a year ago. Instead, the stock market ran up about 25% more before this long-anticipated drop began last Friday, bouncing back a bit yesterday.

You may remember that on November 5, 2015, the market hit an all-time high, slipped a bit, bounced back up, and then began dropping in earnest on January 1, 2016. Back then, our Market Update quoted FDR by saying, “the only thing we have to fear is fear itself”, because the pullback wasn’t based on any material developments in the economy. By February 11, the S&P 500 stock market index was down 11.2% for the year. But by April 19th, the market was setting new highs again. Since then, we’ve had an incredible run, with the markets regaining what was lost and posting an 21.84% return for 2017.

On Monday, we saw the Dow Jones Industrial Average drop 1175 points, or about 4.6%. This drop comes after one of the market’s biggest monthly gains – almost 7% by January 29. Markets are now up just slightly since January 1st. The ironic thing is that the stock market drop was caused by good news.

The number of Americans filing for unemployment benefits fell more than expected last Thursday, and the unemployment rate stands at 4.1%, its lowest level in 17 years. Companies have been reporting their 4th Quarter 2017 earnings and the numbers have been, almost without exception, fantastic. S&P 500 companies earnings have grown about 13.4% from a year ago. With the corporate tax rate cut from 35% to 21%, shareholders after-tax earnings got a more than 20% boost. So, much of the increase we’ve seen in stock prices is because as companies’ profits go up, the market values those companies more highly, as it should. Some of the increase in prices is based on the price of companies per dollar of earnings (called the P/E ratio) going up – stocks getting more expensive - and that has been our concern. P/E ratios for S&P 500 companies based on expected earnings for the year ahead were up to about 18 (versus the 10-year average of 14.2), which is why the stock market seemed “ pricey”. But these ratios have been much higher at times in the past and will, no doubt, go higher at times in the future.

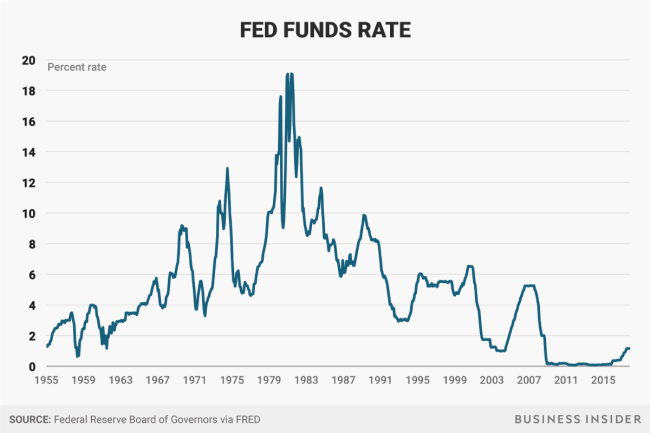

The Federal Reserve’s new chairman Jerome “Jay” Powell was sworn in to replace Janet Yellen on Monday, February 5th, two days after his 65th birthday. The Federal Reserve’s mission is to keep unemployment and inflation low. To achieve that, the main tool they use is to raise or lower market interest rates by adjusting the “Federal Funds Rate”. In the aftermath of the Great Recession in 2008, the Federal Reserve began cutting interest rates to help improve the economy. You can see from the graph below, by the end of 2008 The Federal Funds Rate was at zero.

The idea is that if businesses can borrow at extremely low rates, that will encourage them to borrow and expand their business which is great for the economy. Since then, the economy is much improved and unemployment is at the lowest it has been since 2000 and inflation has also been kept in check (2.11% in 2017 versus an average of 3.13%). Since late 2015, the Fed has started increasing rates again. Because we are now in an environment of low unemployment, wages are expected to rise because with a limited number of workers searching for jobs, companies need to raise wages to recruit talent. Rising wages can lead to an increase in inflation. To combat that, the Federal Reserve increases interest rates so that businesses don’t grow too fast and cause the economy to “overheat”. Recently, we’ve seen interest rates rise in anticipation of those measures fairly quickly which is causing concern to the market. The interest rate on 10-year government bonds went from 2.06% on 9/7/17 to 2.85% on 2/2/18. That’s why the good news of a stronger than expected economy, low unemployment, and strong corporate profits can actually spell more volatility as investors worry that the Fed may raise rates faster or sooner than expected, which could cool markets down or cause recession in the long run.

History shows that it is normal for markets to go through these cycles. Of course, it would be great to know when these events will happen, but that would be like knowing prior to the NFL season that the Eagles were going to win the Super Bowl for the first time in the history of the world. What we’ve seen in the stock market this week isn’t nearly so extraordinary.