When we walk into a bank and want to invest our money safely by buying a CD (thereby lending the bank money for a fixed time period), we expect a higher interest rate for a 10 year loan than a 2 year because we’re giving them our money for a longer time period. In the same way, we as borrowers pay a higher interest rate for a 30-year mortgage than a 15-year. It’s normally the same way for government bonds (loans to the US government). Today, for the first time since 2007, that expectation is not the reality. Investors now get a lower rate of interest on 10-year government bonds than 2-year bonds. That has traditionally been a bad sign for the economy - an indicator of a possible recession coming in the next year or two.

Why would the yield curve invert? Well, like stocks, bonds trade in an auction market. If a lot of people want 10-year bonds, the prices are bid up and the yield-to-maturity (the interest rate you’ll get on your investment) goes down. If conservative investors expect the economy to weaken and the US banking system (the Federal Reserve) to lower short term interest rates in response to try to stimulate growth again, they may prefer longer term government bonds, driving yields on these bonds down. That could be the situation we see playing out.

Why do they think the economy is going to be weak? First, some background. Our GDP (Gross Domestic Product) is the value of all of the products and services our country produces. It is how we track the health of our economy. If our GDP is growing at a strong, steady pace – that’s obviously good – our economy is expanding. If our GDP is shrinking for two consecutive quarters, that’s when we are technically considered to be in recession.

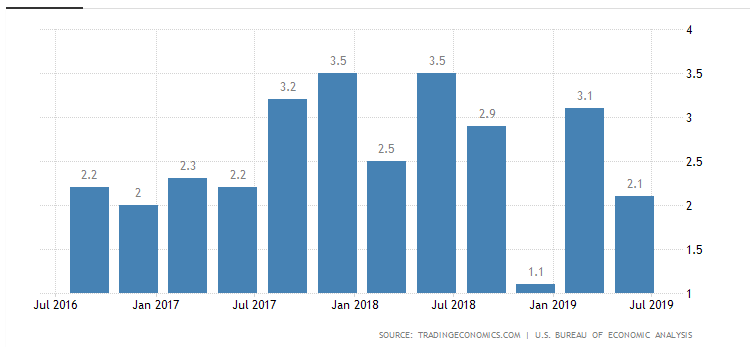

In the second quarter of last year, annualized US GDP growth was at 3.5%. That slowed to 2.9% in Q3 and 1.1% in Q4. Do you remember how the stock market dropped so much at the end of last year? That was partially because when our GDP went down to 1.1%, a lot of people thought (incorrectly then) that we were going into a recession. In the first quarter of 2019, GDP growth bounced back up nicely to 3.1% and stocks jumped with it. We saw things slowing again in Q2 and GDP dropped back to 2.1%, which still isn’t bad. Corporate profits are still strong and stock prices are reasonable - a bit high relative to long term averages, but most experts believe that’s justified based on the low interest rates we see now.

So, what does this mean for me? For our clients whose portfolios we have carefully designed with allocations to stocks versus bonds based on their personal goals, time frame, and tolerance for risk – nothing! We continue to believe that stocks will outperform bonds over the long term, but their values will fluctuate more. But in an environment where both the inflation rate and the dividend yield on stocks are higher than the interest rate on 10-year government bonds (now only 1.59%), it pays to own stocks over time. Recent market developments also highlight the value we add by rebalancing – selling components of your portfolio that are up to lock in gains and maintain a consistent risk level over time. Be prepared for possible rough seas ahead, but know that we’ll be here to help you accomplish your goals. And don’t hesitate to call us if you’d like to chat.

Dave’s thoughts on Stress and Investing

Over the years in investing, I have found that it does not pay to get too excited. Successful investors tend to be optimistic people who have loving and fulfilling relationships, are involved in challenging and meaningful activities, and aspire to maintain a stable lifestyle that incorporates healthy, active living and sound sleep. If we feel loved, respected, and secure, we tend to make good decisions. When we feel threatened or fearful, our more primal instincts of fight-or-flight take over and rational decision making becomes much more difficult.

Imagine you were out for a walk and suddenly a large dog came running full speed across a yard at you, barking, and he did not look happy! The physiological stress response is quick and substantial, with adrenaline and cortisol, an increased heart rate, and more. The Mayo Clinic published a series of articles this year discussing how in many patients, stress events they experience in their daily lives are triggered so frequently that they feel like they are under constant attack and their fight-or-flight response stays turned on, overexposing them to stress hormones and increasing risk of a whole host of health problems – anxiety, depression, heart disease, sleep problems, the impairment of memory and concentration, and more.

Lately, it seems like nearly everywhere I look, I am bombarded with things to be outraged at, threatened by, or fearful about. As the presidential campaigns pick up steam, events are magnified, with both sides of the political aisle stirring the pot and trying to use each news event to stoke outrage at the other and to create strong emotional responses that could accrue to their benefit. I am not writing about politics, the news, or social media. I am writing about how our engagement with these things can threaten our well-being. If they make us feel insecure, angry, or fearful when in reality that is not our situation, perhaps we should reduce our exposure. If they impact our relationships or leave us angry at our neighbors - especially neighbors we don’t know – perhaps we should change our paradigm.

Highly successful clients often tell us “When I know the market is down, I just don’t open my statements. I pay you guys to worry about this stuff!” I have to laugh at the simplicity and effectiveness of this strategy, although our legal department has advised us not to recommend it.

I am not suggesting that we be uninformed, but I believe that a heightened self-awareness of what triggers stress in us is valuable (note: if you’re screaming at the TV, that’s a sign!) so we can step back and make conscious decisions about what to expose ourselves to. Leaving a little earlier for appointments, turning off the TV, unfollowing a few friends on Facebook whose posts drive us nuts, and instead taking quiet time to pray or think, calling a friend, or going for a walk outside can be important steps to safeguarding our mental and spiritual well-being. The truth is that life an amazing adventure. Our neighbors are not simply “good” or “bad”. Most are well-intentioned, flawed human beings, whose views are informed by their life’s experiences, just like us. And people matter. Relationships matter. Love matters. So be kind! Be optimistic! You just might sleep better at night, be a little bit happier, and be a more relaxed and successful investor.

Personal updates

Dave: I had an amazing summer! Last month, I surprised my best friend Tiffany by asking her to marry me and she said YES!

My parents, my sons, and I headed out to St. Louis, MO where we visited my sister and her husband and their 6 children for our summer vacation. We had a blast!

Justin and Steph have been busy getting baby Emma’s room ready. She is expected to arrive later this month.

Leslee and her family had a great time visiting Disneyland!

Jon is a member of the Frick Boat Club in Allentown where for more than 30 years the club has hosted its annual Good Shepherd Rehabilitation Day. Club members host Good Shepherd residents on their boats for an afternoon of fun motor boat rides on the Lehigh River. The residents and caretakers are then treated to a picnic of grilled hot dogs, baked beans, and homemade desserts prepared by boat club members.

Hope you are all having a great summer! We are looking forward to seeing you at the car show!

Cordially,

Dave, Justin, Jon, Reta, and Leslee (The Milestone Team)

P.S.

While we decline to comment on whether buying one is a good financial decision, have you seen the new Corvette??