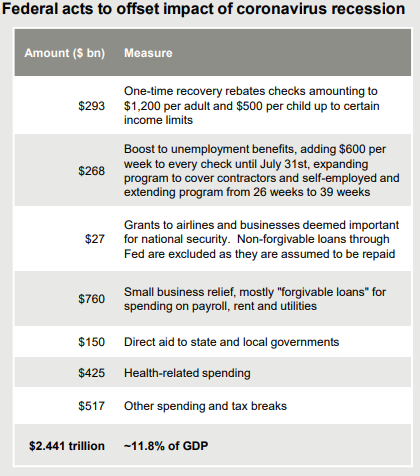

The markets started the year off strong as the S&P 500 (large U.S. stock market index) reached an all-time high on February 19th as the markets produced a 5.11% gain in the first 34 trading days. Those gains were quickly erased when concerns of the Coronavirus began sweeping the world. From February 19th to March 23rd the index was down 34%. Since March 23rd, the government and the Federal Reserve have spent unprecedented amounts of money to help support the economy.

Source: CBO, JPMorgan Asset Management

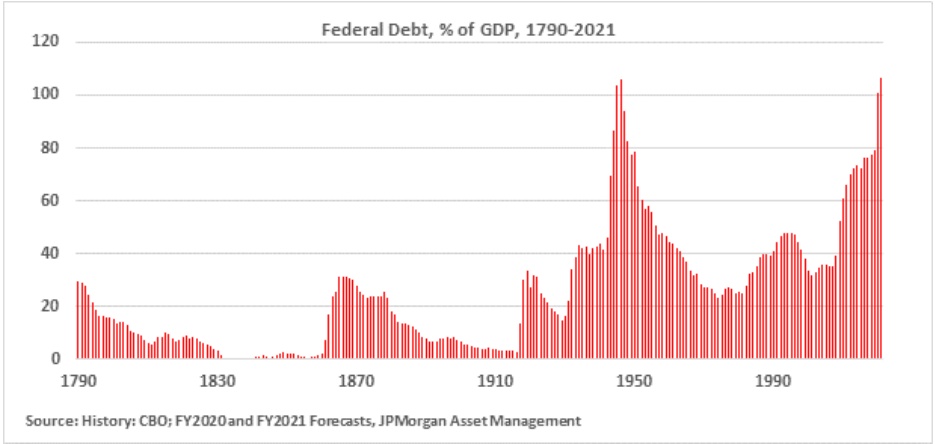

The actions the government has taken have led to massive federal debt levels – levels we haven’t seen since World War II.

These high levels of debt have caused the dollar to depreciate and assets like gold to rise. Given the dramatic increase in new money, many investors are expecting inflation to be an issue in the future. Inflation, broadly speaking, really hasn't been an issue as it has been at or below 2% for the last 10 years. That could certainly change in the future.

|

|

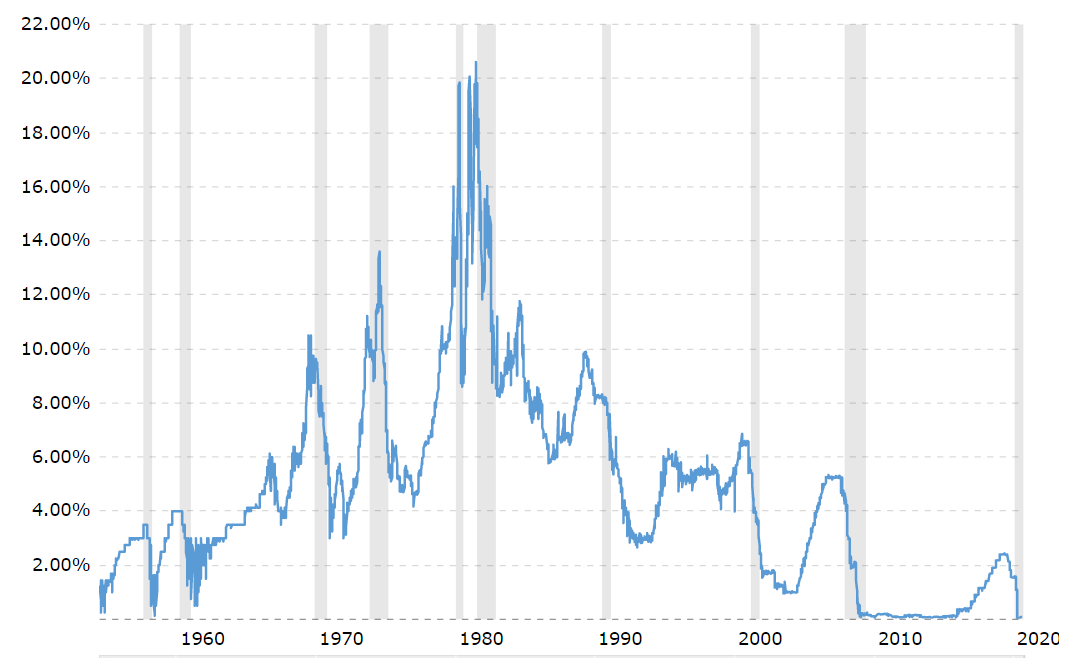

While the bond market has had a good year and really a great run over the last 40 years, it seems things are setting up for a challenging environment going forward. When interest rates decline, the value of a bond goes up, and interest rates have consistently been declining since 1980 with a few slight ticks up along the way. It seems that interest rates don’t have much more room to fall unless they go negative like they have in Germany and Japan. With rates expected to stay low, we anticipate low returns from bonds over the next few years.

Source: Historical Federal Funds Rate - Macrotrends.net

This is concerning for conservative investors as they really have no choice but to take more risk with their investments to avoid losing value. Remember that while a bank may pay you an interest rate like 0.25% to hold your money, if inflation is greater than that, you are actually losing purchasing power. This environment is leading investors to other assets like stocks and gold.

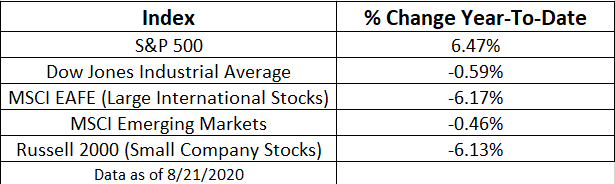

Speaking of stocks, while we hear that markets are back to all-time highs, that performance has been driven by a few large tech companies that have benefited from an accelerated adoption of technology due to COVID-19. As you can see below, many stock market indexes are negative year-to-date.

We have been proactive in making changes to your investments as the economic environment has changed.

Milestone News

Birthdays have been different for everyone this year!

John recently celebrated his 12th via a Zoom call with friends and Emma turned 1 surrounded by family at home.

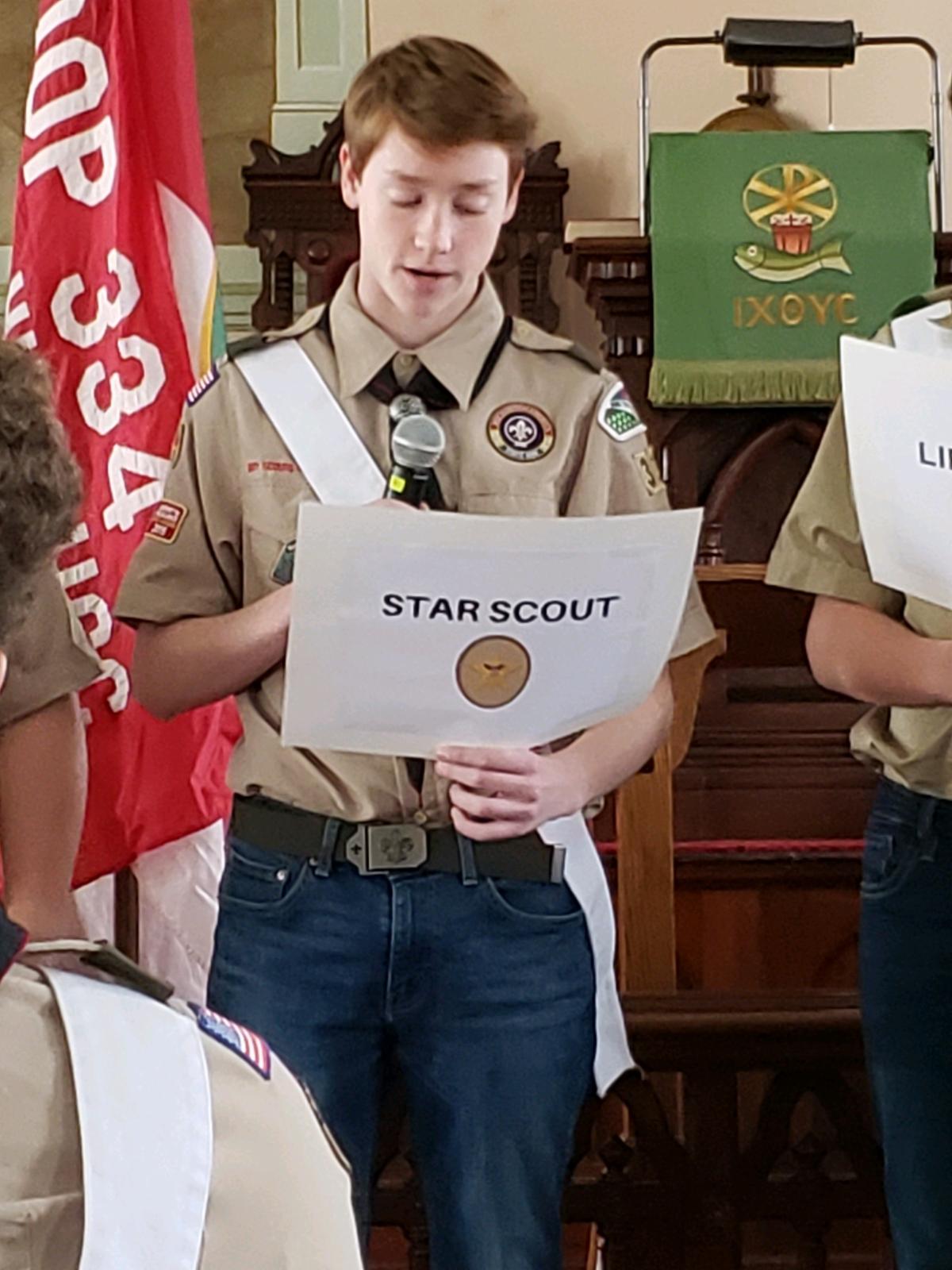

Dave has been keeping the boys busy with Boy Scouts. They participated in a food drive and Ben has just been approved for work on his Eagle Scout project which will benefit the Wildlands Conservancy.

Reta's granddaughter Lark is growing quickly! Reta says she is changing so much and her personality is definitely emerging!

If you’d like to discuss the changes we’ve made, have personal updates, or you’d like to review your portfolio outside of your normal review please let us know!

Warmest Regards,

Dave, Justin, Reta, and Leslee (The Milestone Team)

David S. Coult, CFP®, CLU®, ChFC®, QPFC

President

Justin R. Miller, CFA®

Chief Investment Officer