The stock market began 2020 hitting new all-time highs as investors appear optimistic about corporate earnings and the trade deals with China, Mexico, and Canada.

What is interesting is while the S&P 500 Index was up over 30% in 2019, earnings from S&P 500 companies were, on average, flat to slightly down (not all companies have reported 4th quarter earnings yet so we don’t have final numbers). We’d love to see higher earnings driving the market up, but instead we are seeing valuations expand (willingness to pay more for the same amount of earnings) driven by investor confidence. We also see companies using their profits to buy back shares of their own stock, which reduces the number of shares outstanding and therefore increasing the price per share of their stock. The ultra-low interest rate environment we are in is no doubt contributing to investors willing to take more risk to get return and therefore piling into stocks. The dividend rate on the S&P 500 is currently around 1.74% while the 10-year Government bond is yielding 1.52%.

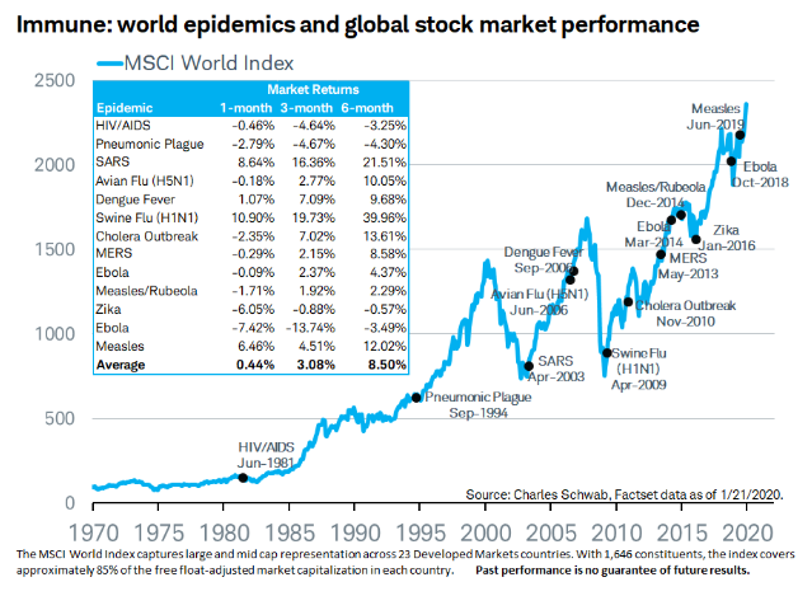

The corona virus outbreak is obviously serious, not just because of the death toll and the people affected (normal flu kills far more people each year than the corona virus has so far) but because of the disruption it has caused in the world’s second largest economy – China. When China shuts down, many of the factories that make components that go into American products stop being built. When travel and trade between the largest economy in the world and the second largest economy in the world are dramatically slowed, it has very real effects. We don’t know how serious this will be or how long it will last, but the market has been resilient to past outbreaks, such as measles, Ebola, SARS, and Zika.

Looking forward, the broader economy remains healthy, unemployment, interest rates, and inflation all remain low, and consumers debt levels are relatively low. We see challenges in manufacturing, slowing global economic growth rates, and increased political uncertainty with the election. As we see the stock market near all-time highs, in our periphery we see indicators that convince us we are in the late stage of the stock market expansion. This isn’t good or bad; it’s just part of the investment cycle. Slowing growth doesn’t mean the stock market won’t continue to do well, it very well could continue, however, it does mean that certain investments may be more attractive now than they were say 5 years ago. We have been active in rebalancing our portfolios little by little to investments that perform better in the late stage of an economic expansion. We aren’t trying to time the market but instead are being disciplined about taking profits when they come and focusing on helping you accomplish your financial goals. It is human nature to want to own more stocks as they are doing well, but it is important to not let either greed or fear drive our investment decisions.

- Raises the age for Required Minimum Distributions out of pre-tax retirement accounts (IRAs, 401(k)s) from 70.5 to 72.

- Allows for retirement plan contributions regardless of age, as long as the investor has earned income.

- Eliminates the lifetime “stretch” IRA option. Non-spouse beneficiaries who inherit an IRA account must withdraw the balance within 10 years.

- Expands qualified expenses from a 529 college account to include apprenticeships as well as the ability to use up to $10,000 (lifetime) to repay student loans.

Dave: My oldest son Ben (in the middle) just turned 16 and earned his Life Scout Rank this week.

His next step is Eagle Scout! In the picture below, the kids are helping out at Northern Lehigh Food Bank.

Justin and Steph welcomed Emma to the world on August 22nd, 2019. Emma is doing well and loves watching her big sister Ellie play.

Unfortunately for Justin and Steph, sleeping is not something she enjoys...