Losing a loved one is never easy and it’s certainly not any easier if they leave us prematurely. You will want to make sure you are covered appropriately during your working career to ensure your family can continue financially without you. So what should you do and what should you look out for?

- Meet with a financial advisor and ask them to evaluate how much insurance you need. They will ask about your situation and talk through your finances to figure out how much insurance your family should have. Paying off debt, replacing a portion of your income to provide for your family, and providing funds for child care and college are typically key considerations. An industry rule of thumb is 10x your salary but each situation is different and depending on your financial goals the numbers can be drastically different.

- There are various types of insurance you can buy but the key difference is some policies are permanent (universal or whole life) with an investment component attached and some policies are temporary and only cover you for a specified length of time (term). Permanent policies will cover you for as long as you live but come at a much higher cost and often require premiums over the life of the policy. While of course saving is a good thing for your future, saving using a permanent life insurance policy can be inefficient.

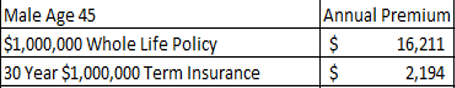

Consider the below example comparing the cost of a whole life policy to a term insurance policy.

You can see that the whole life policy costs an extra $14,017 more per year. Hypothetically, the $14,017 could be invested. If the investor invested the difference each year and earned an 8% return on the money, it would be worth $1,714,921 after 30 years. This is much larger than the $721,402 the whole life policy is projected to have in “cash value” after 30 years. Because of this, we often recommend buying term insurance to keep your insurance and investments separate.

3. Ask your advisor or insurance agent how they are paid and what their commission will be based on which policy you choose. In the above scenario, the whole life policy may pay the advisor a substantially larger commission than the term life insurance policy – a slight conflict of interest. Be wary of someone trying overly hard sell you a certain type of life insurance product. It shouldn’t be that complicated!

If you are considering buying life insurance or would like to review your current insurance coverage, give our office a call!

This hypothetical example is for illustrative purposes only. Insurance values vary by age, health, insurer and other factors. Term insurance policies expire or rise in cost following the level term period, and there is no guarantee of future insurability. Contact your financial professional for more information specific to your situation. Fixed insurance products and services offered are separate and unrelated to Commonwealth.