One of the most common concerns early retirees (pre-age 65) have is healthcare costs. Because it is one of the largest expenses in retirement, it often leads to people delaying retirement for the sole purpose of maintaining their employer-sponsored health insurance. If they decide to retire and can no longer participate in an employer plan, the costs of buying their own health insurance are astronomically higher. Consider this: for a married couple both age 60 purchasing health insurance on their own, their combined annual healthcare premium will fall between $23,280 and $32,592 depending on the level of coverage they choose. This is a significant amount to budget for while you are still working, let alone in retirement! Relief will arrive when the couple reaches age 65 and qualifies for Medicare. At that point, they will see their annual combined cost of insurance fall to the $7,000 - $8,000 range. Luckily, with careful planning, the pre-age-65 couple has options to dramatically reduce their cost for insurance.

If the couple mentioned above retires at age 60, they will need to find coverage elsewhere. They will likely go to healthcare.gov to shop various coverage options. Healthcare.gov plans are offered on a bronze, silver, and gold coverage level with a gold plan being the most comprehensive. The Affordable Care Act (ACA or more commonly referred to as Obamacare) was implemented in 2010 and mandated that all Americans had to be insured. It also provides subsidies for lower-to-middle income people. Through subsidies, early retirees can save a substantial amount on healthcare costs. The amount of subsidy you qualify for is driven by your household size and a measure called Modified Adjusted Gross Income (MAGI). Simply put, MAGI is your total income before any deductions. NOTE: Your assets do not factor into the calculation.

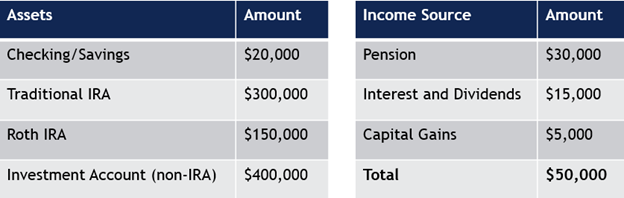

Let’s look at an example of how this works. Assume our couple above has the following financial picture:

Let’s also assume that they determined they need roughly $7,000/month or $84,000/year to retire the way they want to (golfing, walking on the beach, sailing – you know, all the retirement clichés). Given their current income of $50,000 (pension, interest and dividends, and capital gains), they will need an additional $34,000/yr. from their investments. Depending on how they take that income out of their retirement and investment accounts will determine how much they will pay for their health insurance coverage and may ultimately determine whether they retire or not.

Let’s take a look at two retirement income withdrawal scenarios that will drastically alter the cost of their healthcare plan. After shopping for plans on healthcare.gov, the couple decides to purchase a Silver plan that will cost them $29,983 per year combined.

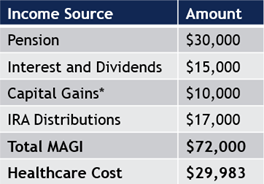

Scenario 1

They choose to take half of the $34,000 from the investment account and the other half from their Traditional IRA. By doing so, their income now looks like this:

*The additional distribution from the investment account caused them to incur more capital gains

Given that their MAGI is $72,000, they do not qualify for a subsidy and will have to pay the full $29,983 price of the plan.

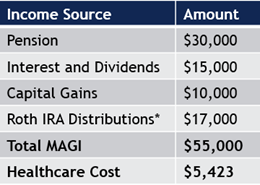

Scenario 2

They choose to take half of the $34,000 from the investment account and the other half from their Roth IRA. By doing so, their income now looks like this:

*Qualified Roth IRA distributions do not count towards MAGI

Under this scenario, with a MAGI of $55,000 they qualify for a substantial healthcare subsidy. Even though they are able to enjoy the same level of lifestyle ($7,000/month), by redirecting how they receive their retirement income, they will now only pay $5,423/yr. combined for health insurance! That is a savings of $24,560/yr. or 82%!

Hopefully you can see how critical planning is to achieving a successful retirement. If you have questions, please feel free to call our office or click here to schedule an appointment.