To the chagrin of many taxpayers, this rhetorical question will be asked many times when 2018 federal tax returns are filed. Of course, most Americans give to charity because they are passionate about an organization and its cause, not because they are looking for a tax deduction. However, if you can give to charity AND lower you tax bill at the same time, it’s a win-win situation!

Standard Vs. Itemized Deductions

Taxpayers have the option of taking the larger of either the standard deduction or the total of their itemized deductions to reduce the amount of income they will owe tax on. The standard deduction is a flat amount (based on your filing status) that all taxpayers qualify for on a no-questions-asked basis. The second option is to itemize your deductions. Itemized deductions include items like charitable contributions, medical expenses, state and local income taxes, and real estate property taxes. Once a taxpayer adds up the total of their itemized deductions, if the total is larger than the standard deduction, they can deduct that larger amount. If the total is smaller than the standard deduction, they will take the larger standard deduction. The key takeaway is that you only receive a tax benefit from charitable contributions if the total amount of itemized deductions is larger than the standard deduction.

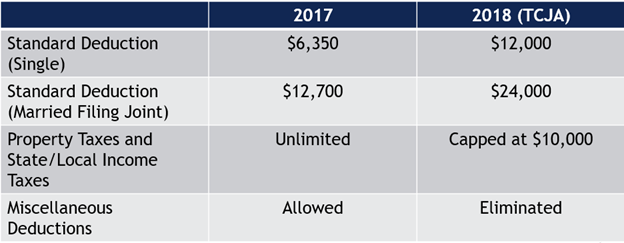

Some of the Tax Cuts and Jobs Act (TCJA) changes to the tax law are outlined below:

The TCJA almost doubled the standard deduction while simultaneously putting a cap on the property and state income tax deductions and completely eliminating miscellaneous deductions. This means that to receive a tax benefit for your charitable contributions, your itemized deductions will need to double while key deductions are being capped and/or eliminated. This is like trying to lose weight by running on a treadmill while eating cake!

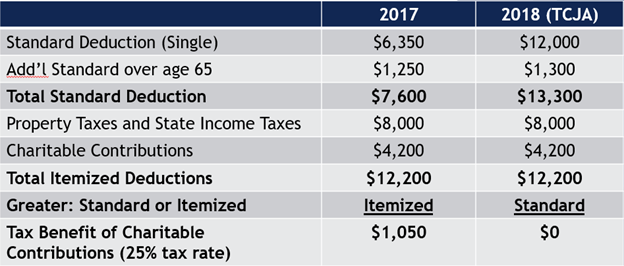

To illustrate the effect of the TCJA, let’s take a look at Steve who is age 72 and a single taxpayer:

While Steve previously receives a tax deduction for his charitable contributions, he will no longer under the TCJA. He is one of the estimated 90% of American taxpayers that will take the standard deduction under the TCJA. Is there anything else Steve can do? Of course!

Solution: Qualified Charitable Distribution

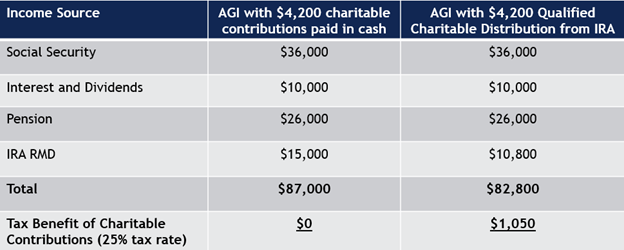

The IRS requires that investors must take distributions (Required Minimum Distributions or RMDs) from Traditional (pre-tax) IRAs beginning at age 70 ½ and continue those distributions for as long as they live. If they choose to have a portion of that required distribution sent to charity, they can do so without incurring tax on that amount. The technical term for this is “Qualified Charitable Distribution”. This is a great solution for someone like Steve who no longer receives any tax benefit from charitable contributions paid in cash and is subject to RMD rules. Let’s look at the difference between Steve making the same $4,200 of charitable contributions in cash versus a QCD:

Steve only pays taxes on the portion of his RMD that does not go to charity. So rather than being taxed on the full amount of his $15,000 RMD, by making his charitable contributions directly from his IRA, the $4,200 that is excluded from his income saves him an estimated $1,050 (assuming he is in the 25% tax bracket). By utilizing this strategy, Steve benefits from the larger standard deduction and lower tax brackets of the TCJA, while still receiving a tax benefit from his gifts to charity!

If you have questions about how the TCJA may affect your charitable giving or would like assistance setting up Qualified Charitable Distributions, please click here to schedule an appointment.

*Neither Commonwealth nor Milestone Financial Associates provide tax or legal advice. Please consult a tax or legal professional for advice regarding your specific situation.